Infineon, Adidas and MTU: The three best DAX stocks over a five-year period in the BÖRSE ONLINE check

- By sennenqshop/li>

- 695

- 27/12/2022

The first six months of the current year are already over. If you take the German stock market as a benchmark, then it was a good half-year. Although the DAX lost a good one percent in value on Wednesday, the leading German share index was up 13.38 percent at the halfway point in the year. In historical comparison, this is an above-average performance.

On the way up, the Dax has already set new records several times this year. Thanks to this record hunt, there is a convincing chart picture. In any case, the long-term upward trend is completely intact. According to chart technology, the prospects for the second half of the year can also be classified as constructive. Incidentally, despite the coronavirus bear market in the meantime, the balance sheet for the past five years is also convincing. Currently, the DAX has increased by a good 60 percent for this period. Most market participants should be satisfied with this result. However, stock pickers with the right nose could of course do much better, or in the case of a negative case, look into the tube. For example, the three biggest DAX losers have even had to report losses in terms of performance over the past five years. The third-last Continental lost almost 27 percent, the second-last Fresenius a good 33 percent and the last Bayer even more than 43 percent. Compared to that, it looks much better at the top of the performance ranking list. With Adidas, the number two has an increase of 144.38 percent, with MTU Aero Engines as number two it is 149.31 percent and with the top value Infineon even 149.31 percent take a breather in the first half of 2021. In all three cases, the performance is currently below the DAX result (Infineon: 9.84 percent, Adidas: +6.58 percent, MTU: -2.25 percent). We take this as an opportunity to subject the three high-flyers of the past five years to a BÖRSE ONLINE investment check.Adidas share

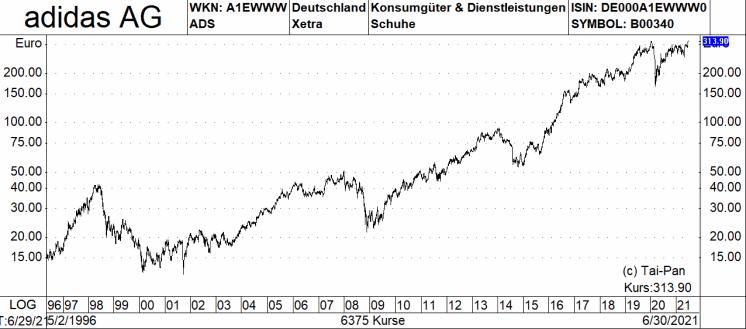

Adidas, the third best value in the five-year performance comparison of the DAX representatives It is the second largest player in the global athletic footwear and apparel market after Nike. This brings with it a strong market position and the company can also come up with a very comprehensive product and brand portfolio.Chart technique: In the context of the current European Football Championship and in the run-up to the soon to begin Summer Olympics in Tokyo, this value succeeded this Tuesday to mark a new final record high of EUR 317.50. This is a circumstance that makes it easy for us to take stock of the charts. Because if it is not a bull trap, then the new record can be equated with a procyclical buy signal. This is at least supported by the fact that the new record seems to have ended the break that has been going on since mid-January 2020. At the same time, there is some evidence that the overriding long-term upward trend has resumed. In this context it should be noted that Adidas has not only given a strong performance on the stock exchange over the past five years. Rather, the bottom line is that the note has been steadily increasing for a much longer time. The price journey started from a Xetra closing record low of EUR 11.93 on September 20, 2001. Structure/strategy: From a strategic point of view, one of the core strengths of the Herzogenaurach-based group is its well-positioned and strong brand image. In particular, the Adidas brand is successfully associated with technical and performance-oriented products, as well as casual and fashion-oriented sportswear, two coexisting markets that are both showing significant growth rates and are driven by different consumer bases, according to analysts at US financial services firm CFRA.Zu note that Adidas competes with a variety of sportswear companies, including Nike and Puma. However, according to CFRA, Nike has less developed product lines for the leisure sector than Adidas, which analysts there believe means that Adidas is better positioned to take advantage of the growing women's segment. An increasing "direct-to-consumer" offer also contributes to a good positioning. The sale of the Reebok brand, which has underperformed under the Adidas umbrella, should be completed by the end of 2021. If things go as planned, the management could concentrate even more on the core business. The in-house plans envisage group sales between 2021 and 2025 in the range of eight to ten percent p.a. a. to increase.Valuation: In terms of valuation, the analyst consensus sees a rise from 2020 to 2024 from EUR 2.21 to EUR 14.52 per share. Even on the latter basis, this still results in a P/E ratio of 21.6, which looks rather high.However, the growth prospects put that into perspective and the market allows the top dog Nike even slightly higher valuation ratios on a P/E basis other major sporting events in the summer will give the Franconians a permanent media presence until September. For the second quarter, company boss Kasper Rorsted is aiming for a sales increase of almost 50 percent. The entry into the recycling textile company Spinnova goes hand in hand with a contribution of three million euros to the upcoming IPO. Adidas thus secures access to the Spinnova products. According to unconfirmed reports, there are now five serious bidders for the US subsidiary Reebok. A sale in conjunction with the sports summer could bring new momentum. The existing buy recommendation has a price target of EUR 360.00 (closing price on Wednesday: EUR 313.90) and a stop-loss rate of EUR 225.00.MTU Aero Engines share

MTU Aero Engines, a manufacturer of engine modules and components for commercial and military aircraft that also offers maintenance, repair and overhaul services, ranks second in the performance Ranking of the DAX representatives in the past five years. It should be noted here that the title only completed the climb from the MDAX to the DAX on September 23, 2019. And according to Commerzbank, the current data indicates that there is a very high probability that MTU will also be included in the starting composition of the DAX 40 index planned for September 2021. Chart technique: MTU shares have been in existence since June 6, 2005 listed. The issue price at the time was EUR 21.00. After the listing on the stock market, the price only rose to EUR 50.93 in January 2007, before the price then fell significantly and at the end of October 2008 it marked the previous record low of EUR 12.87. The share then blossomed one of the best values on the German stock market - This was ensured by a strong increase up to January 24, 2020 to 286.70 euros. Due to the supplier function for the civil aviation industry, which was hit very hard by the corona pandemic and will take some time to "normalize", according to Commerzbank, a bear market accompanied by several sell signals set in at MTU in the course of the general corona virus slump. As in the "waterfall", the title collapsed, according to the Commerzbank chart technicians, with the technical sell-off then ending in March 2020 at EUR 97.8. Here the title - parallel to the DAX - turned up, but the share did always maintain relative weakness status during price recovery. On June 7, the share managed to just surpass the interim high of EUR 221.00 from December 2020 at EUR 223.00. But then the note couldn't go any further. Rather, the price has recently fallen back into the medium-term sideways trend that has been in place since mid-October 2020. A technical buy signal is only given when there is a sustained jump above the aforementioned interim high of EUR 223.00. Position/strategy: Munich-based MTU Aero Engines AG describes itself as Germany's leading engine manufacturer. The Executive Board sees the core competencies in low-pressure turbines, high-pressure compressors, turbine center frames as well as manufacturing and repair processes. According to its own assessment, it plays a key role in new civilian business with the development, manufacture and sale of high-tech components within the framework of international partnerships. It goes on to say that MTU components are used in a third of the world's commercial aircraft. In the field of civil maintenance, it is one of the top 5 global service providers for aircraft engines and industrial gas turbines. In the military field, the company is also the system partner for almost all of the Bundeswehr's aircraft engines. Overall, this results in a good market position and the company can also be granted competitive advantages that help in doing business. According to DZ Bank, MTU has been negatively affected by Covid-19 in the short term, but is structurally well positioned to make the transition from the investment phase (2014- 17) to benefit into the "harvest phase" (2018-25). The geared turbofan engine in combination with service contracts based on flight hours should lead to better profit development in the medium term. Lower start-up losses from slower rising GTF deliveries during the crisis could not have compensated for falling MRO contributions (new engine business diluting margins). However, the group margin could stabilize more quickly as a result of restructuring and vaccines. The bottom line is that with a view to the business outlook, much will depend on whether and when everyday life, which has been changed by the corona virus, returns to normal. Valuation: According to the analyst consensus, the company could succeed in increasing sales from EUR 3.977 billion in 2020 to EUR 6.415 billion in 2024. At the same time, the estimates for earnings per share for this period provide for an improvement from EUR 5.26 to EUR 10.98. On the latter basis, this results in an estimated P/E ratio of 19. This means that the valuation would be justifiable if the forecasts come true and business continues to go up in the years that followBÖRSE-ONLINE assessment: However, it is the starting position also entails a number of risks. As a consequence, BÖRSE ONLINE classified the title as a sale in issue 20-21. This happened as part of an assessment of all 30 DAX stocks,where apart from MTU with Delivery Hero only one other index member also received a sell vote. In addition, Fresenius Medical Care received a hold rating, while all other DAX stocks received a buy recommendation. However, the reality at MTU is that the company is under pressure in its most important business areas. Because there are fewer flights, the revenues from the important maintenance area are falling. Deliveries of new aircraft are also lower. It is relatively unlikely that the hoped-for normalization of business will take place in 2021. In the courses, however, this has long been discounted. This increases the risk of disappointment.

Infineon shares

An increase of 149.31 percent, as mentioned at the beginning, has made Infineon shares the top performer among Dax members in the past five years. The winner is a company that designs, develops, manufactures and markets a wide range of semiconductors and complete system solutions for a variety of electronics end markets. It is a diversified semiconductor company spanning the markets of communications (wireless, wired), PC, Automotive and industry served. Infineon is divided into the business areas Automotive, Industrial Power Control, Power Management & Multimarket and Digital Security Solutions.Chart technology: The title has an interesting long-term chart to offer. Interesting because the IPO took place at the end of the mega TMT bubble in March 2020. The issue price was EUR 35.00 and in the wake of the general euphoria that prevailed at the time, the first price of EUR 70.20 doubled. At the end of June 2020, it then peaked at EUR 92.50 This record high, which has not yet been reached, was then followed by a descent to just EUR 0.39 as part of the general bursting of the TMT bubble. This final record low dates from March 9, 2009 and served as the basis for a convincing comeback in the years that followed. On the way up, it has so far been enough to rise to EUR 36.60. A level that dates from February 19, 2021. However, this date also signals that the price has been consolidating since then. However, the character of this movement can currently be classified as trend-confirming. This means that the chances are not bad that the overriding upward trend will resume after the end of the breather. Position/strategy: Thanks to specific solutions for the automotive industry, industrial and consumer-related applications as well as security solutions, the Munich-based company is one of the top ¬players in the respective segment. According to the analysts at Landesbank Baden-Württemberg (LBBW), the company is thus benefiting from the ongoing trend towards a steadily increasing proportion of semiconductors in a wide variety of products/applications. Industry 4.0, autonomous driving or the general increase in digitization should be mentioned here. With the acquisition of Cypress Semiconductor for the equivalent of around 8.3 billion euros, Infineon has joined the list of the world's ten largest semiconductor manufacturers according to LBBW. In addition to the previous leading position in power semiconductors and safety controllers, Infineon is now the No. 1 semiconductor supplier for the automotive industry. In the medium term, the Munich-based company will benefit even more from increasing digitization (increasing data traffic, Internet of Things, autonomous driving, mobile communication). The analysts at Berenberg Bank also think similarly favorably about the position of Infineon. They are generally positive about the increase in the proportion of semiconductors in cars. It is believed that the growth in semiconductor content will be at least in the range of six to eight percent per year over the next few years due to the increasing demand for safer and smarter cars. Infineon also dominates the market for power transistors. Together with the microcontroller (MCU) capabilities, this results in a competitive advantage because flexible and adaptable solutions can be developed. Berenberg Bank is positive about Infineon's leading position in the power semiconductor market and believes that the company is well-positioned to benefit from the trend towards the introduction of electric vehicles.Valuation: Looking at the average analyst estimates, Infineon is based on revenues from the 2019/20 financial year (September 30) to the 2023/24 financial year, an increase from EUR 8.567 billion to EUR 14.007 billion. In addition, the forecasts for earnings per share assume an improvement from EUR 0.64 to EUR 1.56. On the latter basis, an estimated P/E ratio of a good 22 is calculated. Visually speaking, this is not low. In view of the good business prospects and the expected increase in earnings, this is justifiable as long as the market's expectations are met.BÖRSE-ONLINE assessment: The investment recommendation for this DAX representative is Buy. This positive vote is understandable with a target price of EUR 42.00 (closing price on Wednesday: EUR 33.82) and a stop-loss rate of EUR 27.00. In issues 19-21 we justified the recommendation as follows: Like all chip manufacturers, Infineon is affected by the tight capacities of contract manufacturers.The fact that the share tumbled after the quarterly results were announced was not due to disappointing figures, but rather to profit-taking in an increasingly volatile market environment. Demand in the end markets is picking up sharply. This applies above all to the automotive industry, where more and more chips and sensors are being installed in the power electronics of electric vehicles. And with the $9 billion takeover of Cypress Semiconductor, a manufacturer of microcontrollers, software and high-performance memory elements, Infineon has significantly strengthened its foothold in a wide variety of application areas such as data centers, electric vehicles and energy networks. Infineon not only delivered convincing quarterly figures, but also slightly raised its forecast for the 2020/21 financial year ending on September 30. Sales should come out at eleven billion euros, all with a segment result margin of 18 instead of the previously expected 16.5 percent. Free cash inflows are expected to increase by 50 percent to EUR 1.2 billion. Due to the high demand, Infineon wants to bring forward the production start of the new chip factory at the Villach site, which is planned for the end of 2021. Up to 2.4 billion euros are to flow into the expansion of the Dresden chip factory. Finally, we also reminded that the high valuation reflects the expectations of the markets. Any disappointment in projected growth could lead to sell-offs.

Image source: BÖRSE ONLINE, BÖRSE ONLINE, BÖRSE ONLINE, BÖRSE ONLINE, BÖRSE ONLINE, BÖRSE ONLINE